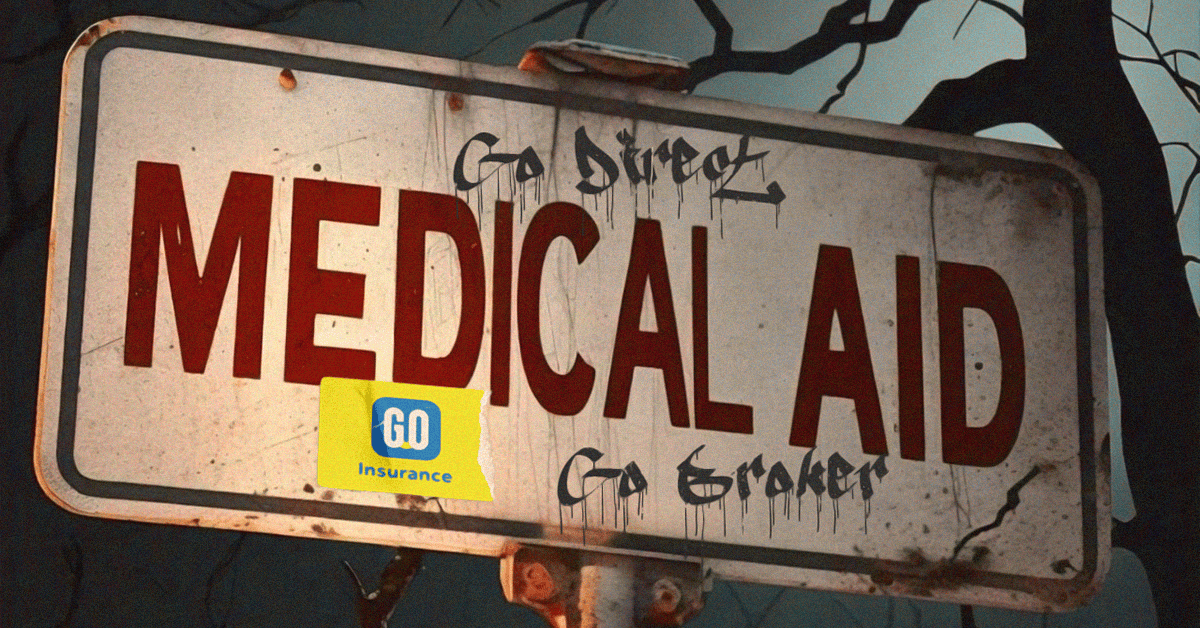

Just like Freddy Kruger haunts his victims’ dreams, insurance nightmares can haunt you if you’re not careful! But instead of a razor-sharp claw, it’s costly insurance mistakes that’ll keep you up at night.

Mary’s Medical Aid Nightmare:

At Go Insurance we regularly catch up with brokers on our panel. During a recent coffee meeting, we heard a horror story that perfectly sums up why good advice often goes a long way.

Mary, an elderly lady who had not been on medical aid for many years, approached a seasoned healthcare broker for assistance with joining a scheme. The problem was that Mary wasn’t completely honest with the broker upfront and didn’t tell him she had already contacted the medical scheme she wanted to join, directly, and submitted her application.

Unfortunately, Mary had not fully disclosed her previous medical history when she called the scheme directly, which led to her application being rejected.

Had Mary consulted the broker before rushing off to the scheme directly, the broker would have pointed out the following:

- The need for Mary to be fully transparent about her previous medical history.

- That a waiting period would be applied & what this would mean for her.

- That a late-joiner penalty would also apply & what this means.

Need to chat to a qualified broker about your medical aid options? Click here to WhatsApp us

Mary went direct, but didn’t understand the implications and botched her opportunity to join a medical scheme and get the cover she needed. Now the broker cannot reprocess the application and Mary sits without cover in her late 60s.

A real nightmare…

When Should You Consider Go Broker?

We’ll be exploring four reasons why we would recommend using a broker in upcoming blog posts, but let’s start with:

Good Advice

A good broker will listen carefully and identify your concerns. Then they will advise on the best solution to meet your needs. How do you know if they will advise you on the best solution? Quite simply, legislation requires that they prepare a “record of advice” in which they:

Describe the problem.

Identify the solution for you.

Motivate a product recommendation.

If the recommendation fails to solve the problem, and a complaint arises, then this “record of advice” will form the basis of your claim. And if your broker was negligent, they will be held financially accountable.

Direct insurers can’t offer advice. That doesn’t mean they don’t have a place. It just means that if you go direct, the burden of making the right decision falls on you.

So, don’t let insurance nightmares haunt you. Seek advice from a qualified broker and avoid those costly mistakes.

It’s that time of the year again – medical aid review season!

Are you unsure about your current medical aid plan or looking for expert advice?

Click here and chat with us on WhatsApp now

Best regards,

The Go Insurance Team