What type of insurance policy do most South Africans prefer?

In 2023 almost six million funeral cover policies were sold in South Africa, outstripping the competition by a country mile. Rainbow Nationers do love a braai, a beer and a funeral policy or two 🙂

Why is funeral cover so popular?

- No medical tests required.

- Valid claims paid in 72hrs.

- Add immediate family members to the policy.

- No paperwork at application stage.

- Funeral cover is a real RSA legacy product.

- Policies include extra benefits like airtime.

Unless you have a spare R50 000 lying around to cover an unforeseen funeral expense, you need a funeral cover policy. If you already have a policy, please dust it off and check that your cover is still adequate.

If you still think R20,000 will cover your funeral costs, think again!

Traditional burials often cost around R20,000, but there are additional expenses like burial plots, transport, airtime, flowers and food to consider as well. Comprehensive cremations cost about the same nowadays.

A good starting point for funeral cover is closer to R50 000!

When it comes to funeral cover, it’s essential to face the facts. A policy with a benefit of less than R50 000 will likely leave your family with a financial burden.

Inflation erodes the value of money over time, and what may seem sufficient today won’t be enough tomorrow.

Consider the impact on your loved ones. A R50 000 funeral cover policy taken out in 2014 has lost half its value by today. That’s a significant drop in purchasing power.

Your family may struggle to cover even the most basic funeral expenses, let alone give you the dignified farewell you deserve.

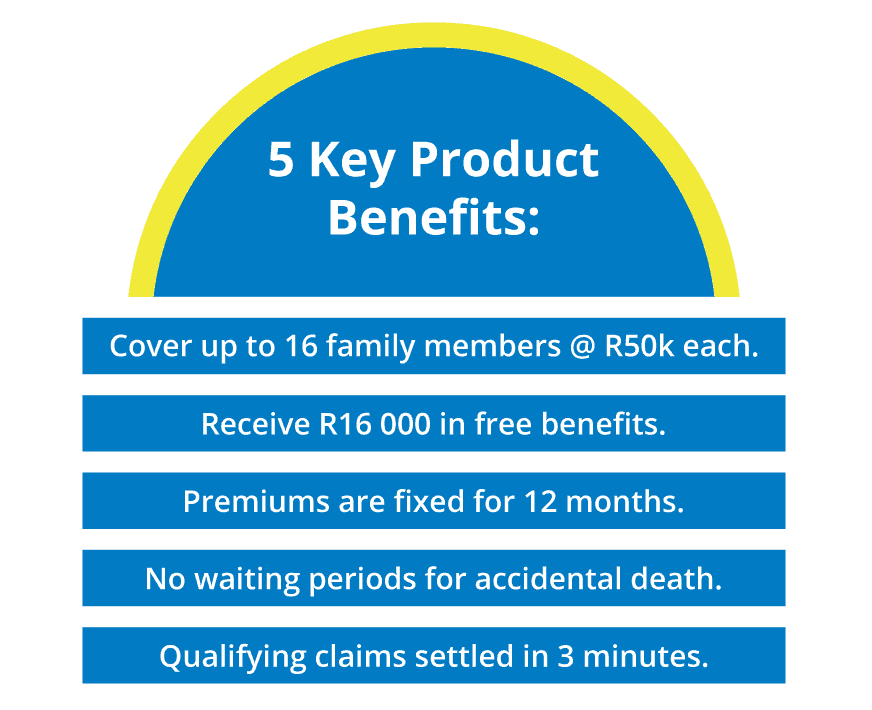

Why choose 1Life Funeral Cover?

The policy is packed with unique benefits. We’ve highlighted the key benefits below:

1Life Insurance Limited is a licensed life insurer & financial services provider.

The Go Insurance Team